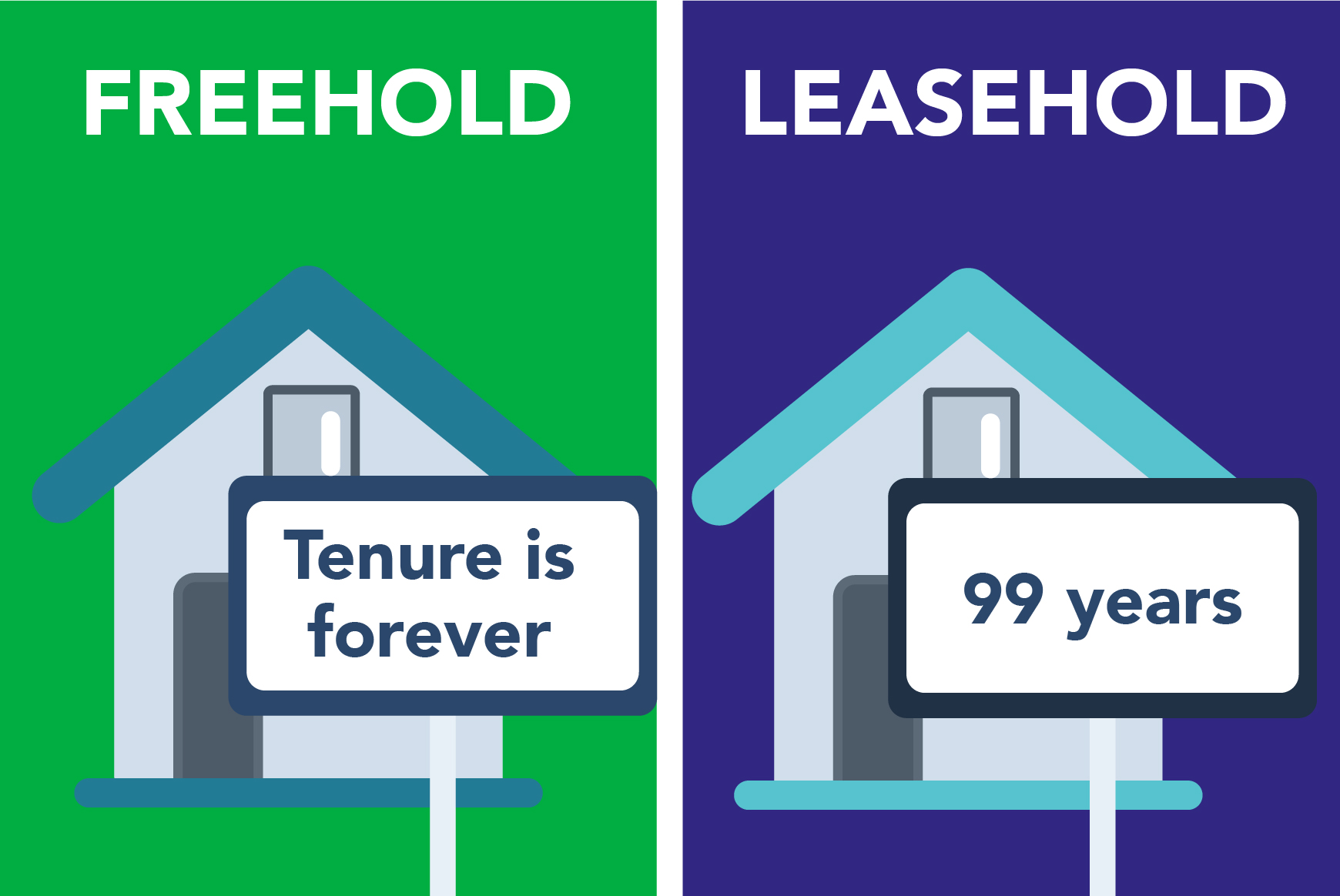

Leasehold vs freehold; whether it’s a condo or landed property, this is an important question to ask when buying a house in Malaysia.

Understanding Freehold Property

Freehold property refers to land or property that is owned indefinitely by the owner without any lease agreement with the government or other authority. Here are key points to know:

Ownership and Types

- Owner’s Control: The owner has full control over the property, including its development and usage.

- Master Title vs. Strata Title:

- Landed Homes: Buyers receive a Master Title, transferring ownership of the land along with the property.

- Condominiums: Buyers receive a Strata Title, giving ownership of the unit but not the land, which remains with the developer.

Advantages

- Flexibility: Fewer restrictions on development timelines and land usage.

- Transfer Ease: Typically simpler and less stringent processes for property transfer.

- Subdivision Rights: Owners can subdivide and allocate the property, subject to local planning controls.

Common Misunderstandings

- Government Control: Despite ownership, governments can reclaim freehold land under certain conditions, such as for public infrastructure projects.

- Compensation: In such cases, owners are compensated based on market value under the Land Acquisition Act 1960.

Understanding these nuances helps prospective buyers make informed decisions about freehold properties and their long-term implications.

Understanding Leasehold Property

Leasehold property in Malaysia is owned by the government and granted to individuals or developers for a specified period, typically 30, 60, 99, or 999 years. Here are key points to know:

Ownership and Restrictions

- Government Ownership: The land belongs to the government, and leaseholders pay a nominal fee for its use.

- Lease Terms: Terms dictate usage rules and responsibilities, including maintenance and development obligations.

- Tenure Limitations: After the lease period expires, ownership reverts to the government unless renewed.

Advantages

- Cost Efficiency: Initial purchase prices are generally lower than freehold properties, making them more affordable for investors.

- Development Focus: Developers often enhance leasehold properties with amenities and features to attract buyers.

Common Misunderstandings

- Transfer Approval: Sale requires state consent, which can delay transactions for several months to a year, affecting resale viability.

- Value Depreciation: Property values may decline as the lease term nears expiration, impacting long-term investment potential.

- Financing Challenges: Banks may impose stricter requirements on leasehold properties, especially as the lease term diminishes, affecting loan eligibility.

Understanding these dynamics helps potential buyers assess the pros and cons of leasehold properties in Malaysia, considering factors like investment horizon, resale potential, and financing feasibility.