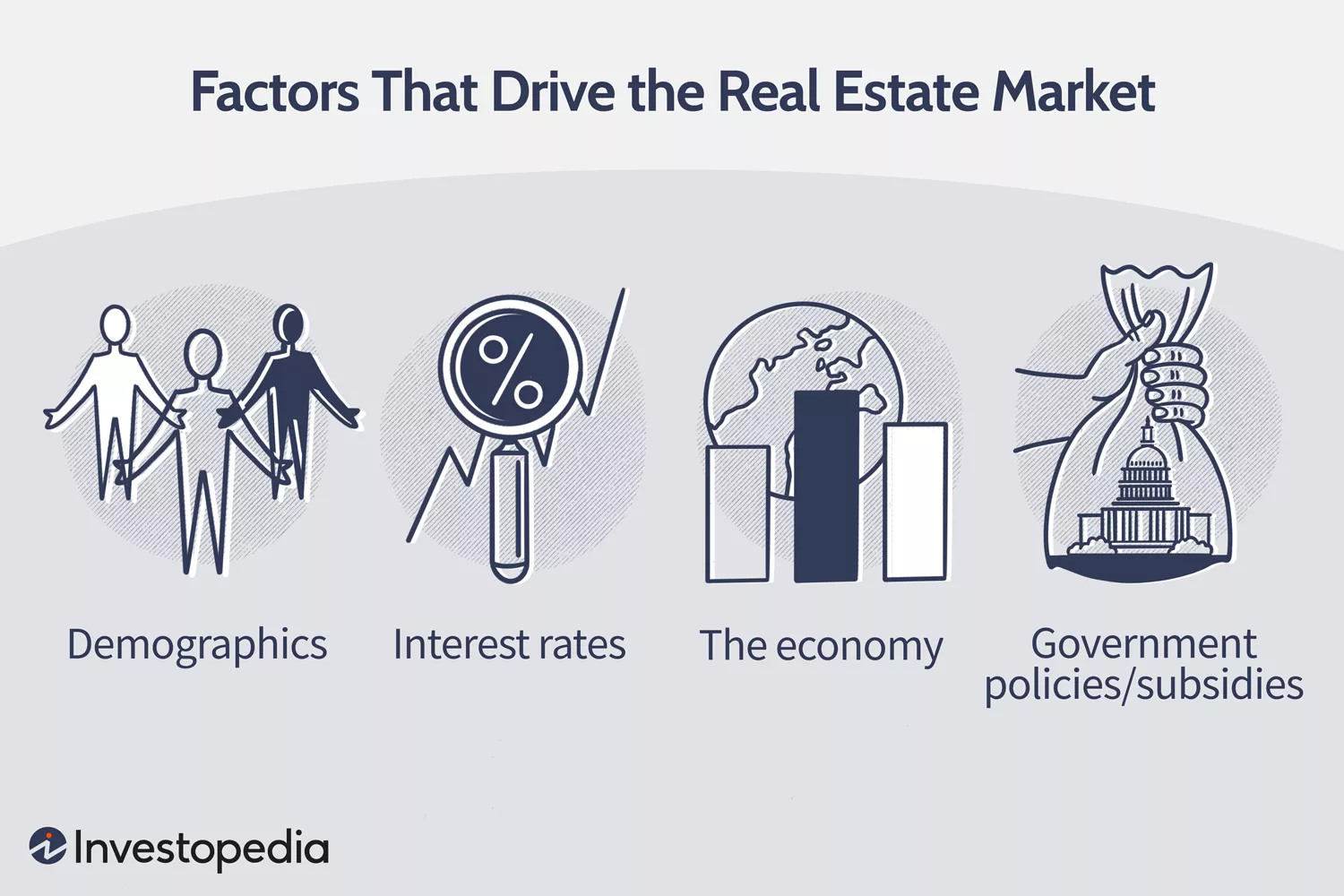

The real estate market is influenced by a variety of factors that can affect property values, demand, and overall market conditions. Here are four key factors that drive the real estate market:

:max_bytes(150000):strip_icc():format(webp)/factors-affecting-real-estate-market.asp_final-8e8ea4cd40dd45909593384700de9759.png)

1. Economic Conditions

GDP Growth: A strong economy with rising GDP typically leads to higher incomes, increased consumer confidence, and greater demand for real estate.

Employment Rates: Higher employment rates and job stability boost people’s ability to buy homes and invest in property, driving up demand.

Inflation: Inflation can impact real estate prices. Moderate inflation can lead to increased property values as construction costs rise, but high inflation can erode purchasing power and reduce demand.

2. Interest Rates

Mortgage Rates: Lower interest rates make borrowing cheaper, increasing the affordability of mortgages and stimulating home buying. Conversely, higher rates can dampen demand as borrowing costs rise.

Loan Accessibility: The ease of obtaining financing affects buyers’ ability to purchase property. Lenders’ willingness to provide loans, influenced by credit standards and regulatory conditions, plays a significant role.

3. Demographics

Population Growth: Areas with growing populations typically see increased demand for housing, driving up prices and development.

Age Distribution: The needs of different age groups (e.g., millennials entering the housing market, baby boomers downsizing) influence market trends and property types in demand.

Household Composition: Changes in household sizes and structures, such as an increase in single-person households or multigenerational living, affect the type and size of properties in demand.

4. Government Policies and Regulations

Tax Incentives: Tax benefits for homeowners, such as mortgage interest deductions or property tax exemptions, can encourage home buying.

Zoning Laws: Regulations on land use and development impact where and how properties can be built, affecting supply and market dynamics.

Subsidies and Grants: Government programs that provide financial assistance for homebuyers, especially first-time buyers, can boost demand.

Regulatory Environment: Laws related to real estate transactions, environmental regulations, and landlord-tenant relationships can influence market conditions and investor confidence.

Understanding these key factors is crucial for navigating the real estate market. Keeping an eye on economic indicators, interest rate trends, demographic shifts, and government policies will help you make informed decisions and anticipate market movements.